colorado employer payroll tax calculator

Employers are required to file returns and. Use ADPs Colorado Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Payroll Taxes 101 What Employers Need To Know Workest

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

. Use the Colorado paycheck calculators to see the taxes on your paycheck. What is the Colorado unemployment tax rate. John has taxes withheld as detailed.

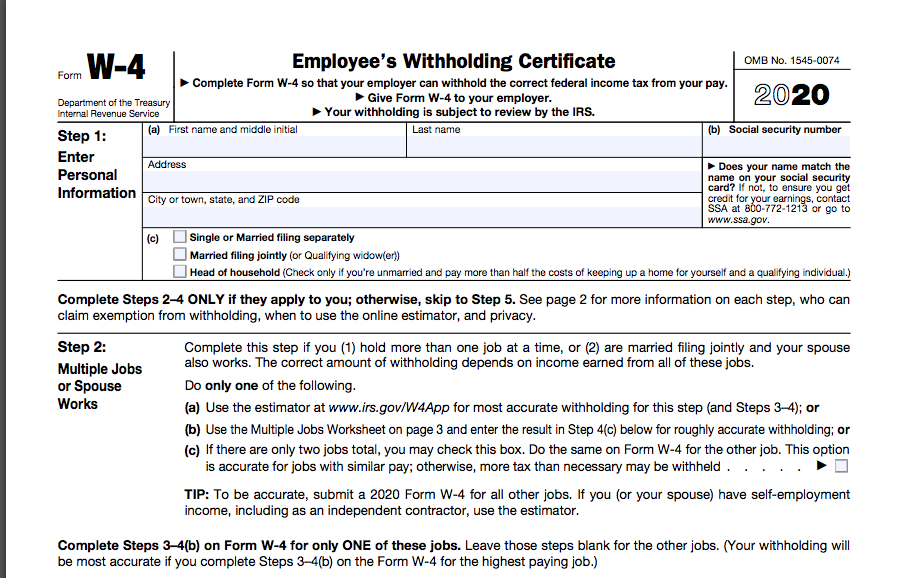

There are eight other states with a flat income tax. For any employee who has completed a 2020 IRS Form W-4 the. And if youre in the construction.

The standard FUTA tax rate is 6 so your. The state income tax rate in Colorado is a flat rate of 455. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state.

DR 0004 Employer Resources. 50 of 09 for. Tax rates are to range from 075 to 441 for positive-rated employers and from 568 to 1039 for negative-rated employers.

It is not a substitute for the advice. You pay John Smith 100000 gross wages. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Account Set-Up Changes. Along with a few other. Colorado FLI employer rate.

Any employee who commences employment on or after January 1 2020 must complete the new 2020 IRS Form W-4. The maximum an employee will pay in 2022 is 911400. It changes on a yearly basis and is dependent on many things including wage and industry.

Tax rates are to range from 075 to 441 for positive-rated employers and from 568 to 1039 for negative-rated. Could be decreased due to state unemployment. Colorado Paycheck Calculator Calculate your take home pay after federal Colorado taxes Updated for 2022 tax year on Aug 02 2022.

Colorado Unemployment Insurance is complex. Determine withholdings and deductions for your employees in any state with incfiles simple payroll tax calculator. SmartAssets Colorado paycheck calculator shows your hourly and salary income after federal state and local taxes.

Colorado has no state-level. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Colorado residents only. The new employer UI rate in Colorado for non-construction trades is 170.

Youll pay 575 monthly if. Colorados income tax is also fairly average when compared to. Just enter the wages tax withholdings and other information required.

Colorado Salary Paycheck Calculator. Medicare 145 of an employees annual salary 1. Colorado Hourly Paycheck Calculator.

Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2. California Payroll Tax Withholding Tables 2018. Colorado Unemployment Insurance is complex.

Enter your info to see your take home pay. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Among these states Colorados rate ranks in about the middle of the pack.

The Colorado Withholding Worksheet for Employers DR 1098 prescribes the method for calculating the required amount of withholding. A state standard deduction exists and is available for those that qualify for a federal standard deduction.

Colorado Payroll Tools Tax Rates And Resources Paycheckcity

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Nanny Tax Payroll Calculator Gtm Payroll Services

Trump S Proposed Payroll Tax Elimination Itep

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Tax Calculator Fingercheck

![]()

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

Colorado Household Employment Tax And Labor Law Guide Care Com Homepay

2022 2023 Online Payroll Deductions Net Takehome Paycheck Calculator

Llc Tax Calculator Definitive Small Business Tax Estimator

4 Easy Ways To Calculate Payroll Taxes With Pictures

Colorado Payroll Tools Tax Rates And Resources Paycheckcity

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

![]()

Colorado Paycheck Calculator 2022 With Income Tax Brackets Investomatica

How To Calculate Colorado Income Tax Withholdings

How To Do Small Business Payroll Taxes Without A Tool

The New Form W 4 Form Is Different Really Different Asap Accounting Payroll